Hi,

Stock price is a continuous data and to manage it, people “discretise” it into candles (or bars). Each bar is a block of time (1d, 1 min etc) defined by open, high, low and close. So note that close of 1D candle on 24th Jan 2025 may be different from LTP on 24th Jan. Close is declared by exchange.

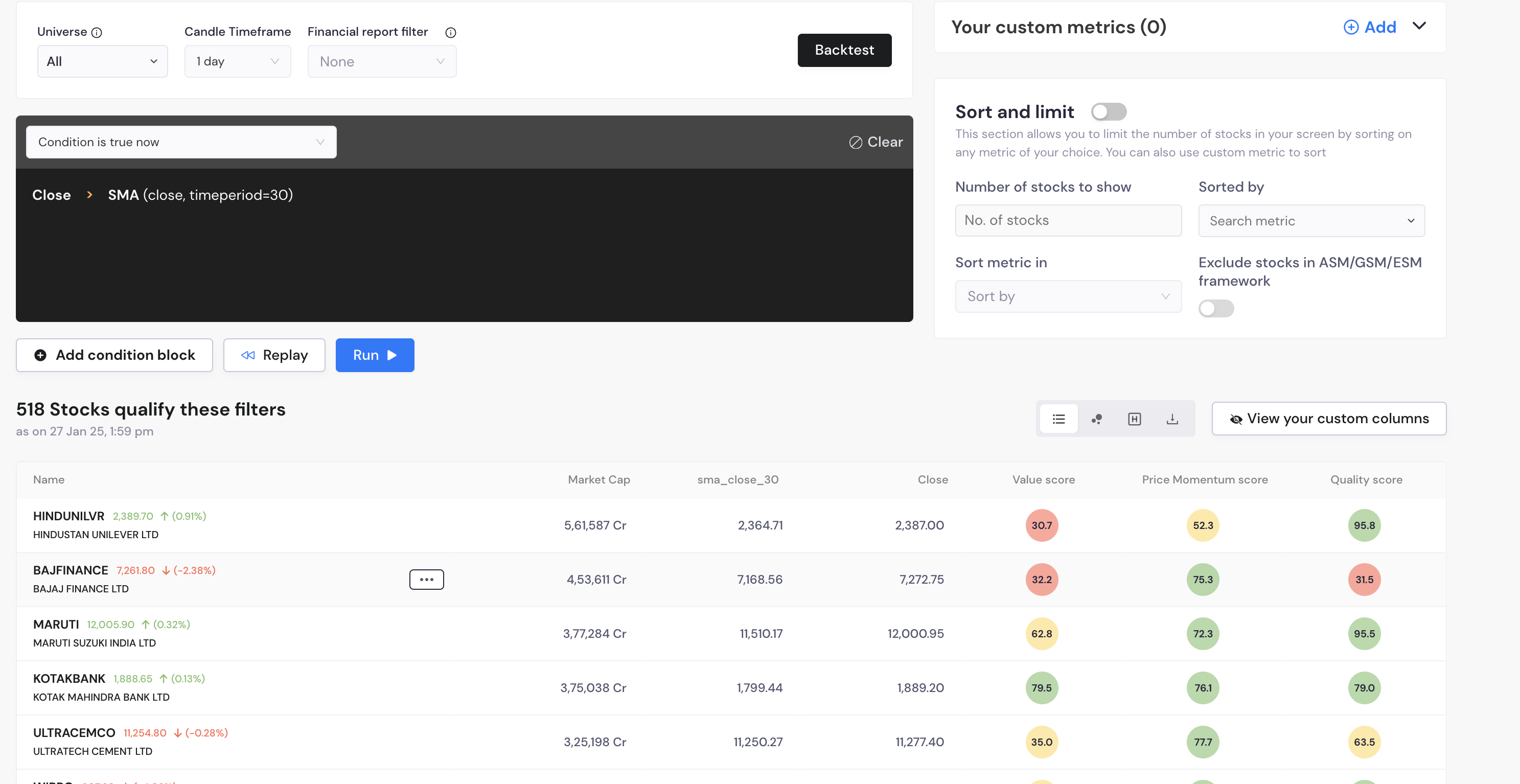

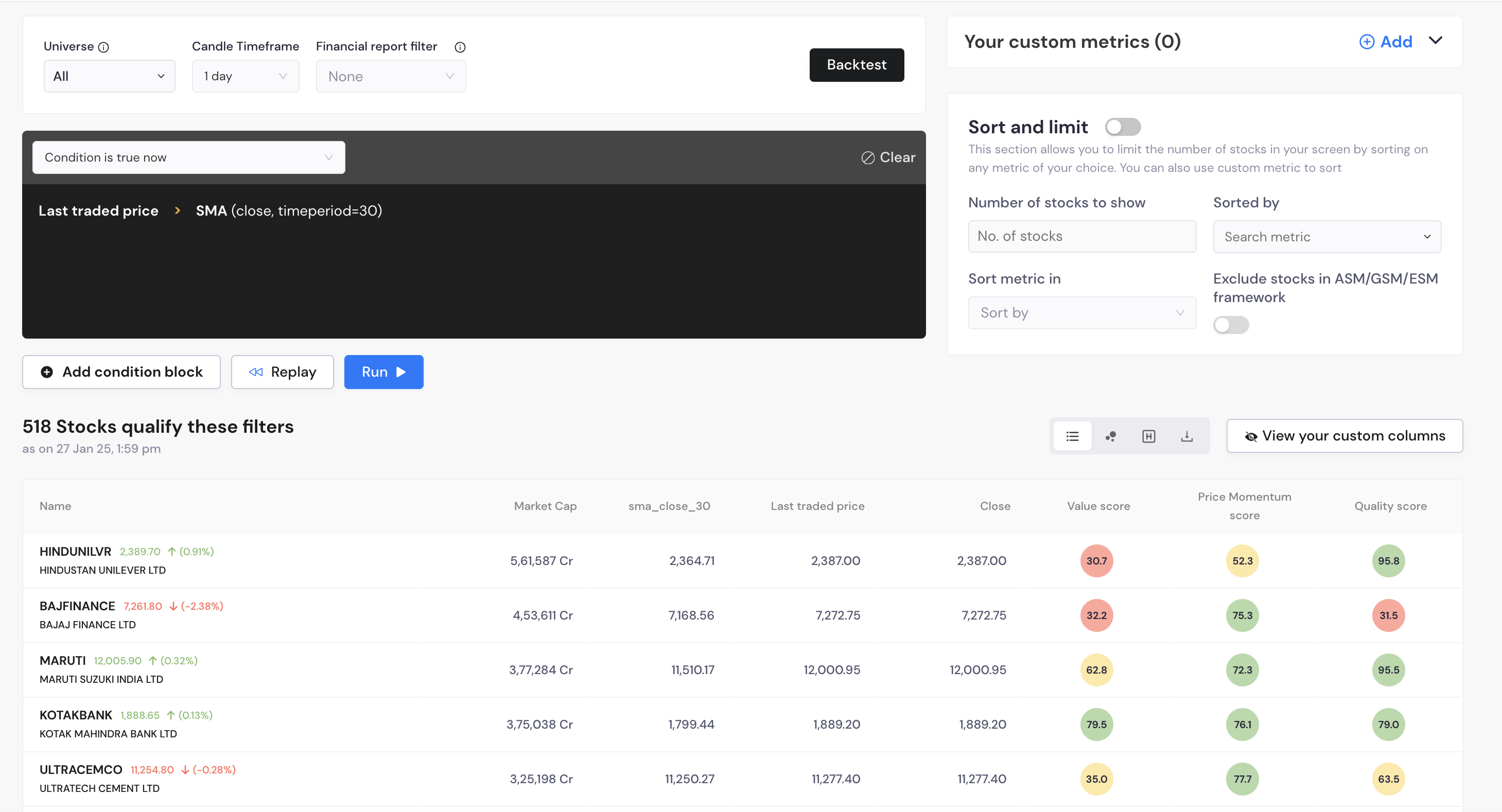

However, in our case, since the lowest timeframe we deal with is “1 min”, for all intent and purposes, close and LTP are the same and should give the same result in screening. See screenshots:

However, in back testing, the results will be different because we do not maintain history of LTP. Therefore, it is always advisable to use close instead of LTP for accurate back testing.